Our balanced approach to net zero

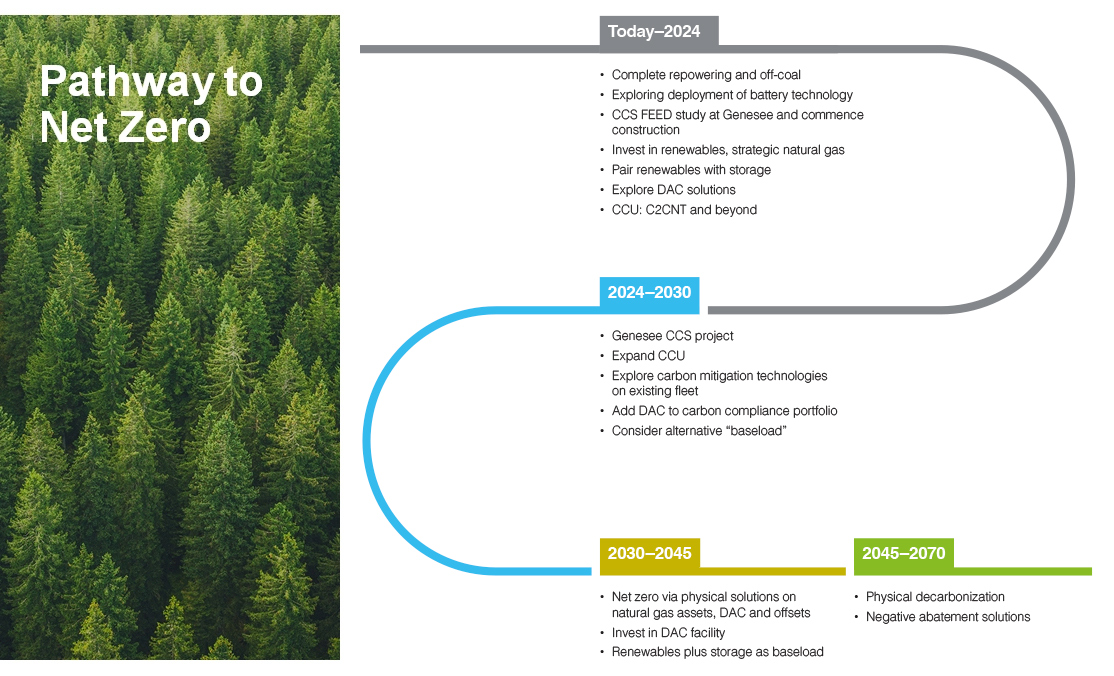

Our goal is to be net zero by 2045. We are committed to staying ahead of the curve and acting as a leader within our industry when it comes to sustainability and environmental, social, and governance (ESG) practices.

Our vision is to electrify the world reliably and affordably while protecting the planet for future generations. It’s our responsibility to do our part to help society meet the long-term challenges facing our planet. These are essential actions to ensure we’re making meaningful contributions to our world. Sustainability is our strategy, and we work to ensure our business decisions support a sustainable future for our environment, communities, people, operations and shareholders. To accelerate our decarbonization efforts, we released a Green Financing Framework – enabling us to issue green bonds and green loans to finance transformative clean energy projects that support the transition to a carbon-neutral society.

We Are Focused On:

-

- Climate change and carbon footprint: Continuous improvement, innovation, dialogue and action to reduce emissions and create a low-carbon energy future are critical across the energy industry.

- Innovation: This is the key to creating responsible, sustainable energy for future generations. This includes both investment in and support for new technologies as well as innovative thinking and approaches to existing systems and processes.

- Water management: Water is a shared and precious resources. We are developing a water management strategy to minimize our water use impact through technological innovation and sustainable water management best practices.

- Sustainable sourcing: We will be holding ourselves accountable and asking others to do the same through the products and services we purchase.

We Have:

- Added sustainability to the board’s mandate.

- Integrated ESG into our strategy and embedded ESG factors into our decisions making.

- Released a Green Financing Framework

We are pleased to receive an (A-) score for corporate transparency and action on climate change and a (B) score for reducing risks and seizing opportunities for water security.